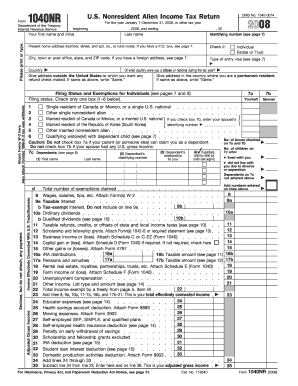

This form does not include many of the deductions or tax credits found in Form 1040, but it offers much more flexibility compared to the 1040EZ. Form 1040A Form 1040A is a less complex version of the standard 1040 tax return. A 1040 is required among self-employed taxpayers, those with an adjusted gross income of more than $100,000, and individuals who underreported tips. Anyone can file this form, but some people must. Although long-winded, a general rule of thumb is that the longer the tax form, the more room for tax breaks. Form 1040 Form 1040 is the most complex out of the three choices, but it also provides numerous options in order to claim deductions and credits. However, there are a few key distinctions between the three that we will go over below.

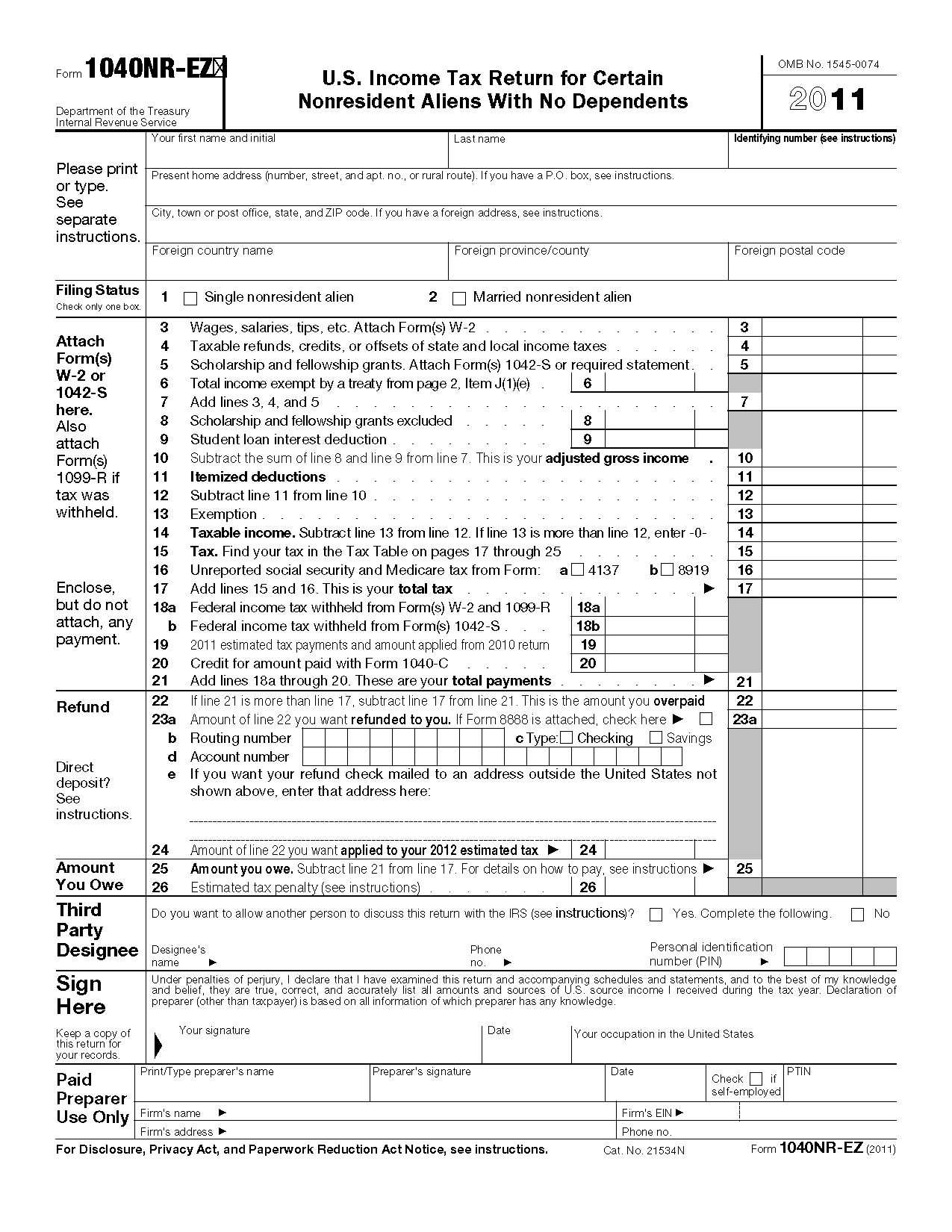

:max_bytes(150000):strip_icc()/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)

What is Form 1040EZ Used For? Like Form 10A, IRS Form 1040EZ is used to file your annual tax return. This form provides individuals with no dependents and basic tax circumstances the opportunity to file their income taxes faster than ever. Form 1040EZ, In come Tax Return for Single and Joint Filers with No Dependents, is a shorter and simpler version of the 1040. What is IRS Form 1040EZ? The Internal Revenue Service (IRS) offers three different filing options for individual taxpayers : Form 1040, Form 1040A, and Form 1040EZ.

0 kommentar(er)

0 kommentar(er)